Table of Contents

UNITED STATES |

SECURITIES AND EXCHANGE COMMISSION |

Washington, D.C. 20549 |

|

SCHEDULE 14A |

|

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. ) |

|

Filed by the Registrant x |

|

Filed by a Party other than the Registrant o |

|

Check the appropriate box: |

o | Preliminary Proxy Statement |

o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

x | Definitive Proxy Statement |

o | Definitive Additional Materials |

o | Soliciting Material Pursuant to §240.14a-12 |

|

West Pharmaceutical Services, Inc. |

(Name of Registrant as Specified In Its Charter) |

|

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

|

Payment of Filing Fee (Check the appropriate box): |

x | No fee required. |

o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| | |

| (2) | Aggregate number of securities to which transaction applies: |

| | |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | |

| (4) | Proposed maximum aggregate value of transaction: |

| | |

| (5) | Total fee paid: |

| | |

o | Fee paid previously with preliminary materials. |

o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| | |

| (2) | Form, Schedule or Registration Statement No.: |

| | |

| (3) | Filing Party: |

| | |

| (4) | Date Filed: |

| | |

| | |

| | Persons who are to respond to the collection of information contained in this form are not required to respond unless the form displays a currently valid OMB control number. |

| | | |

Table of Contents

West Pharmaceutical Services, Inc.

Notice of 2016

West Pharmaceutical Services, Inc. Notice of 2017 Annual Meeting |

530 Herman O. West Drive

Exton, Pennsylvania 19341

March 23, 201622, 2017

The 20162017 Annual Meeting of Shareholders of West Pharmaceutical Services, Inc. will be held at our corporate headquarters on:

Tuesday, May 3, 20162, 2017

9:30 AM, local time

530 Herman O. West Drive

Exton, Pennsylvania 19341

The items of business are:

1.Election of nominees named in the Proxy Statement as directors, each for a term of one year. 2.Consideration of an advisory vote to approve named executive officer compensation.

3.Approval of the adoption of the West Pharmaceutical Services, Inc. 2016 Omnibus Incentive Compensation Plan.

4.Ratification of the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for the 2016 Year.

5.Transaction of other business as may properly come before the meeting and any adjournments or postponements thereof.

| Election of nominees named in the Proxy Statement as directors, each for a term of one year. |

| |

2. | Consideration of an advisory vote to approve named executive officer compensation. |

| |

3. | Consideration of an advisory vote on the frequency of the executive compensation vote. |

| |

4. | Ratification of the appointment of PricewaterhouseCoopers LLP (“PwC”) as our independent registered public accounting firm for the 2017 Year. |

| |

5. | Transaction of other business as may properly come before the meeting and any adjournments or postponements thereof. |

Shareholders of record of West common stock at the close of business on March 8, 2016,7, 2017 are entitled to notice of, and to vote at, the meeting and any postponements or adjournments thereof.

| George L. Miller |

| Sr. Vice President, General Counsel and |

| Corporate Secretary |

Important Notice Regarding the Internet Availability of Proxy Materials for the Shareholder Meeting on May 3, 20162, 2017

This Notice of Annual Meeting and Proxy Statement (“Notice”) and the 20152016 Annual Report (“20152016 Annual Report”) are available on our website at:

www.westpharma.com/na/en/Investors/Pages/ProxyMaterials.aspxhttp://investor.westpharma.com/phoenix.zhtml?c=118197&p=irol-reportsannual

Your Vote is Important

Please vote as promptly as possible electronically via the Internet or by completing, signing, dating and returning the proxy card or voting instruction card.

Table of Contents

| GENERAL INFORMATION |

|

Below is a summary of important information you will find in this Proxy Statement. This summary does not contain all of the information that you should consider, and you should read the entire Proxy Statement carefully before voting.

Summary of Shareholder Voting Matters

|

| | | | |

Recommended

|

| | | | | | |

Proposal 1: Election of Directors | | | | Page 61

57 | | ü FOR |

Mark A. Buthman

William F. Feehery

Eric M. Green

Thomas W. Hofmann

Paula A. Johnson

| Myla P. Lai-Goldman

Douglas A. Michels

Paolo Pucci

John H. Weiland

Patrick J. Zenner

|

| | | Each Nominee |

| | | | | |

|

Proposal 2: Advisory Vote to Approve Named Executive Officer Compensation |

| Page

63 | |

Page 67

|

ü FOR |

| | | | | |

|

Proposal 3: ApprovalAdvisory Vote on Frequency of the Adoption of the West Pharmaceutical Services, Inc. 2016 Omnibus IncentiveExecutive Compensation PlanVote |

| Page

64 | |

Page 68

|

ü FOR EVERY ONE YEAR |

| | | | | |

|

Proposal 4: Ratification of the Appointment of PricewaterhouseCoopers LLP as our Independent Registered Public Accounting Firm for the 20162017 Year | | Page 65 | |

Page 76

|

ü FOR |

|

|

|

| | | |

2016 Annual Meeting and Proxy Statement | 1

Table of Contents

| GENERAL INFORMATION

|

| |

Our Director Nominees

You are being asked to vote on the directors nominated below. All directors are elected annually by a majority of votes cast, except in the case of a contested election where the number of nominees exceeds the number of open positions. Detailed information about each director’s background and areas of expertise can be found beginning on page 62.58. All directors, except Mr. Green, are independent.

| | | | | | | | Current Committee

Memberships | | Other

Current |

Name | | Age | | Director

Since | | Current Occupation | | AC | | CC | | NCGC | | ITC | | Public

Boards |

| | | | | | | | | | | | | | | | |

Mark A. Buthman | | 55 | | 2011 | | Retired EVP & CFO, Kimberly-Clark | | C | | | | M | | | | — |

William F. Feehery | | 45 | | 2012 | | President, Industrial Biosciences, E.I. Du Pont de Nemours and Company | | | | | | | | C | | — |

Eric M. Green | | 46 | | 2015 | | President & CEO, West Pharmaceutical Services, Inc. | | | | | | | | | | — |

Thomas W. Hofmann | | 64 | | 2007 | | Retired Sr. VP & CFO, Sunoco, Inc. | | M | | M | | | | | | 3 |

Paula A. Johnson | | 56 | | 2005 | | Cardiologist; Exec. Dir. of Connors Center for Women’s Health and Gender Biology Brigham and Women’s Hospital | | M | | | | | | M | | — |

Myla P. Lai-Goldman | | 58 | | 2014 | | CEO and President of GeneCentric Diagnostics, Inc. | | | | | | | | M | | 1 |

Douglas A. Michels | | 59 | | 2011 | | President & CEO, OraSure Technologies, Inc. | | M | | M | | | | | | 1 |

John H. Weiland | | 60 | | 2007 | | President & Chief Operating Officer, C. R. Bard, Inc. | | | | C | | | | | | 1 |

Patrick J. Zenner | | 69 | | 2002 | | Chairman, West; Retired CEO & Pres., Hoffmann-La Roche Inc. | | | | | | C | | | | 1 |

| | | | | | | | | | | | | | | | | | | | | | |

| |

| |

| |

| |

| |

|

M

| | Member

| | AC

| | Audit Committee

| | CC

| | Compensation Committee

|

| |

| |

| |

| |

| |

|

C

| | Chair

| | ITC

| | Innovation and Technology Committee

| | NCGC

| | Nominating and Corporate Governance Committee

|

| | | | Director | | | | Current Committee

Memberships | | Other

Current

Public |

Name | | Age | | Since | | Current Occupation | | AC | | CC | | FC | | ITC | | NCGC | | Boards |

Mark A. Buthman | | 56 | | 2011 | | Retired EVP & CFO, Kimberly-Clark | | C | | | | | | | | M | | 1 |

William F. Feehery | | 46 | | 2012 | | President, Industrial Biosciences, E.I. Du Pont de Nemours and Company | | M | | | | | | | | C | | — |

Eric M. Green | | 47 | | 2015 | | President & CEO, West Pharmaceutical Services, Inc. | | | | | | | | | | | | — |

Thomas W. Hofmann | | 65 | | 2007 | | Retired Sr. VP & CFO, Sunoco, Inc. | | M | | M | | M | | | | | | — |

Paula A. Johnson | | 57 | | 2005 | | President, Wellesley College | | | | | | | | C | | | | — |

Myla P. Lai-Goldman | | 59 | | 2014 | | CEO and President of GeneCentric Diagnostics, Inc. | | | | | | M | | M | | | | 1 |

Douglas A. Michels | | 60 | | 2011 | | President & CEO, OraSure Technologies, Inc. | | | | C | | | | M | | | | 1 |

Paolo Pucci | | 55 | | 2016 | | CEO, ArQule, Inc. | | M | | M | | | | | | | | 2 |

John H. Weiland | | 61 | | 2007 | | Vice Chairman, President & Chief Operating Officer, C. R. Bard, Inc. | | | | M | | C | | | | | | 1 |

Patrick J. Zenner | | 70 | | 2002 | | Chairman, West; Retired CEO & Pres., Hoffmann-La Roche Inc. | | | | | | | | | | M | | 1 |

2015LEGEND: M — Member; C — Chairperson; AC — Audit Committee; CC — Compensation Committee; ITC — Innovation and Technology Committee; FC — Finance Committee; NCGC — Nominating and Corporate Governance Committee

2017 Annual Meeting and Proxy Statement

2016 Performance and Compensation Highlights

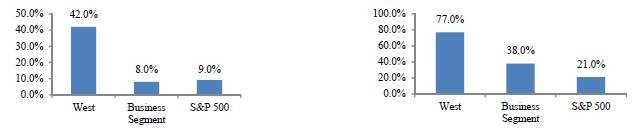

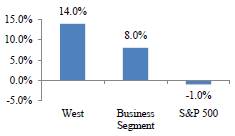

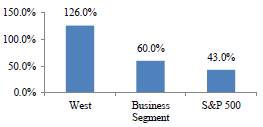

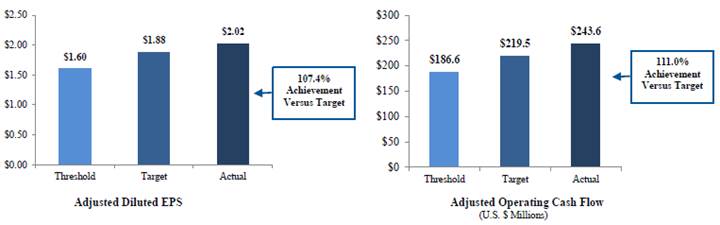

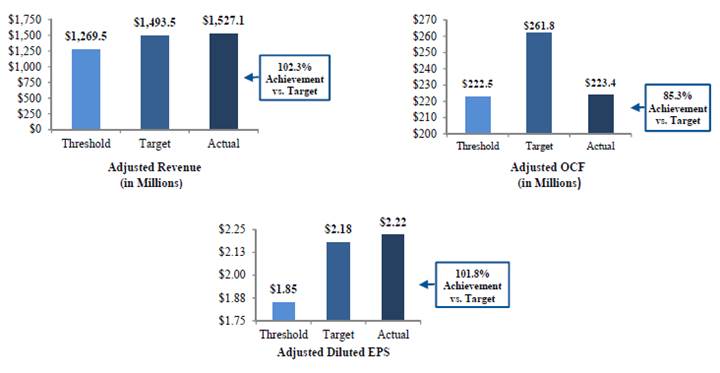

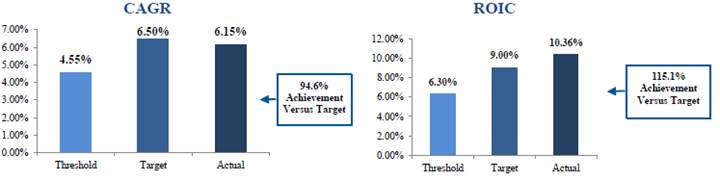

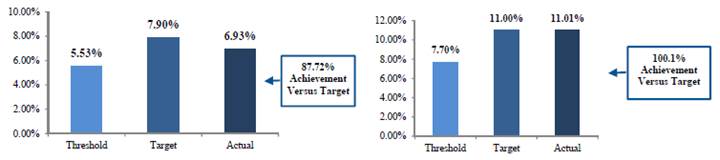

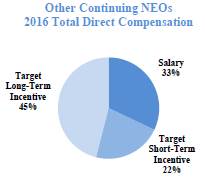

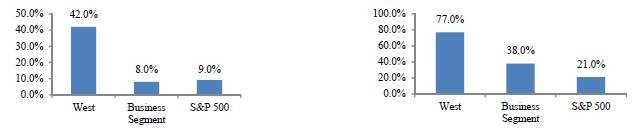

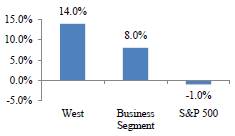

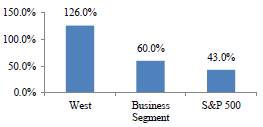

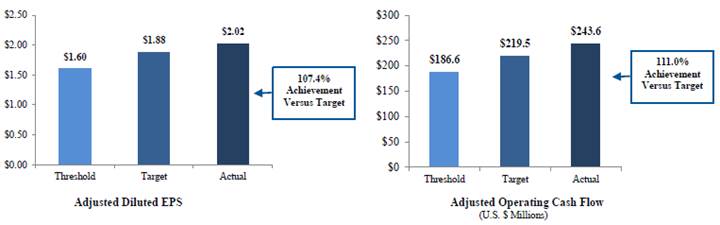

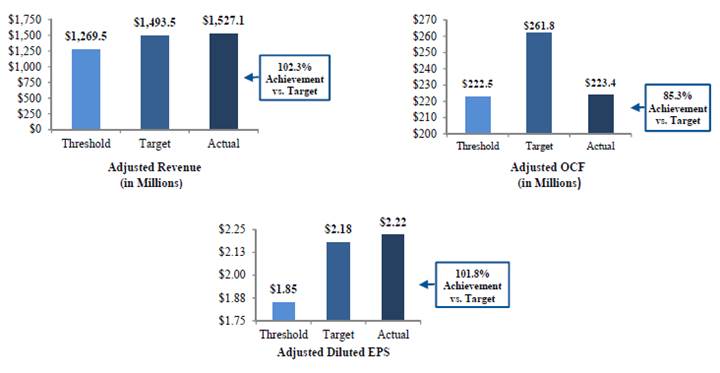

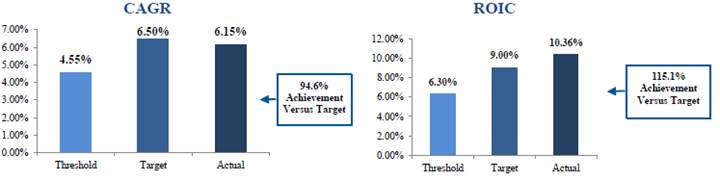

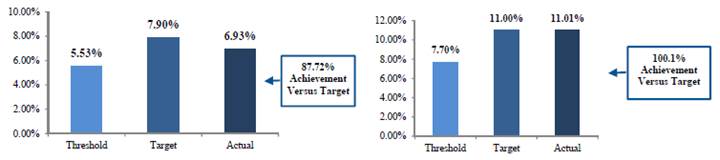

We believe that Mr. Green and the other named executive officers (“NEOs”) performed well in 20152016 and that their compensation is appropriate in relation to that performance. Under their leadership, our Company achieved a total shareholder return (“TSR”) of 14%42% in 20152016 and a cumulative three-year TSR of 126%77%. Those returns reflect our growing sales and profitability. Compared to 2014:2015: net sales grew 7.2%9.1% (at constant currency exchange rates), gross margin grew by 1100.6 margin points to 32.6%33.2%, adjusted operating margin grew 701.2 margin points to 13.6%14.8% and adjusted diluted earnings per share (“Adjusted Diluted EPS”) increased 19%21.3% (at constant currency exchange rates).

(1) 2015 reported net sales decreased 1.5% versus 2014; unfavorable foreign currency translation reduced sales growth by 8.7%. See page 2625 of our 20152016 Form 10-K Annual Report for discussion of the impact of foreign currency rates on reported net sales.

(2) Below is a reconciliation of adjusted dilutedAdjusted Diluted EPS growth at constant currency exchange rates:

| | 2015 | | 2014 | | Change | | 2016 | | 2015 | |

US GAAP Diluted EPS | | $ 1.30 | | $ 1.75 | | -25.7% | | $ | 1.91 | | $ | 1.30 | |

Pension settlement charge | | 0.43 | | | | | | — | | 0.43 | |

Executive retirement and related costs | | 0.09 | | | | | | — | | 0.09 | |

License costs | | | | 0.01 | | | |

Restructuring-related charges | | | 0.23 | | — | |

Venezuela currency devaluation | | | 0.04 | | — | |

Pension curtailment gain | | | (0.01 | ) | — | |

Discrete tax charges | | 0.01 | | 0.02 | | | | 0.01 | | 0.01 | |

Adjusted diluted EPS | | $ 1.83 | | $ 1.78 | | 2.8% | |

Adjusted Diluted EPS | | | $ | 2.18 | | $ | 1.83 | |

Impact of foreign exchange rates | | 0.29 | | | | | | 0.04 | | | |

Adjusted Diluted EPS at Constant Exchange rates | | $ 2.12 | | $ 1.78 | | 19.1% | |

Adjusted Diluted EPS at constant currency exchange rates | | | $ | 2.22 | | $ | 1.83 | |

(3) Gross margin and adjusted operating margin are discussed on page 2726 and page 3129 of our 20152016 Form 10-K.

2016 Annual Meeting and Proxy Statement | 2

Table of Contents

GENERAL INFORMATION

|

|

The following table shows the components of 20152016 compensation paid to our named executive officers, including total “realizable” pay. Realizable pay takes a retrospective look at pay and performance. Realizable pay is the sum of: (1) base salary paid; (2) annual incentive plan amounts actually earned for 20152016 performance; (3) the in-the-money value of stock option grants made in 2015;2016; (4) the current accrued estimate for payouts for the Performance-VestingPerformance Share Unit award made in 20152016 (at 98.5%91.29% of target); and, (5) the 20152016 year end value of any time-vesting restricted stock granted in 2015.2016. The table is not a substitute for our 20152016 Summary Compensation Table set forth on page 45.41.

20152016 Summary Compensation and Realizable CompensationPay

(all amounts in U.S. Dollars)

Name and

Current Principal Position | | Salary | | Bonus | | Stock

Awards | | Option

Awards | | Non-Equity

Incentive Plan

Compensation | | Change in

Pension Value

and

Nonqualified

Deferred

Compensation

Earnings | | All Other

Compen-

sation | | SEC

Total | | SEC

Total

Without

Change in

Pension

Value (1) | | Total

Realizable

Compensation | | | Salary | | Bonus | | Stock

Awards | | Option

Awards | | Non-Equity

Incentive Plan

Compensation | | Change in

Pension Value

and

Nonqualified

Deferred

Compensation

Earnings | | All Other

Compensation | | SEC

Total | | SEC

Total

Without

Change in

Pension (1) | | Total

Realizable

Pay | |

Eric M. Green

President & CEO | | 473,846 | | 616,667 | | 3,174,950 | | 3,175,106 | | 614,259 | | 42,927 | | 267,697 | | 8,365,452 | | 8,322,525 | | 5,788,906 | | | 749,039 | | —0- | | 1,026,285 | | 1,000,020 | | 738,575 | | 70,066 | | 64,142 | | 3,648,127 | | 3,578,061 | | 4,970,851 | |

William J. Federici

Sr. VP & CFO | | 515,483 | | -0- | | 350,015 | | 350,006 | | 447,210 | | 119,960 | | 24,388 | | 1,807,062 | | 1,687,102 | | 1,554,856 | | |

William J. Federici

Sr. VP, CFO & Treasurer | | | 517,264 | | —0- | | 350,027 | | 350,005 | | 375,244 | | 249,457 | | 21,616 | | 1,863,613 | | 1,614,156 | | 2,111,679 | |

Karen A. Flynn

Sr. VP & CCO | | 425,526 | | -0- | | 312,512 | | 326,744 | | 359,630 | | 19,334 | | 33,191 | | 1,476,937 | | 1,457,603 | | 1,304,692 | | | 439,881 | | —0- | | 350,027 | | 350,005 | | 309,960 | | 91,642 | | 27,162 | | 1,568,677 | | 1,477,035 | | 1,969,012 | |

John E. Paproski

Sr. VP & CTO | | 374,196 | | -0- | | 299,990 | | 299,994 | | 272,580 | | 112,865 | | 30,706 | | 1,390,331 | | 1,277,466 | | 1,154,311 | | |

George L. Miller

Sr. VP, GC & Corp. Secretary | | 41,538 | | 66,667 | | 700,065 | | 299,988 | | -0- | | 2,769 | | 13,403 | | 1,124,430 | | 1,121,661 | | 768,951 | | | 400,000 | | —0- | | 299,989 | | 300,011 | | 247,780 | | 27,468 | | 239,945 | | 1,515,193 | | 1,487,725 | | 1,692,754 | |

Donald E. Morel, Jr.

Former Chairman & CEO | | 461,857 | | -0- | | 1,199,991 | | 1,200,030 | | 537,413 | | 965,793 | | 242,107 | | 4,607,191 | | 3,641,398 | | 2,445,128 | | |

Annette F. Favorite

Sr. VP & CHRO | | | 300,000 | | 150,000 | | 158,702 | | 150,028 | | 171,540 | | 28,912 | | 181,709 | | 1,140,891 | | 1,111,979 | | 1,144,077 | |

(1) This column is each officer’s total compensation, as determined under applicable SEC rules, minus the change in pension value reported in the Change in Pension Value and Nonqualified Deferred Compensation Earnings column of the Summary Compensation Table. It shows the impact that change in pension values had on total compensation, as determined under applicable SEC rules, which vary substantially due to actuarial calculations. The amounts reported in the SEC Total Without Change in Pension Value column may differ substantially from the amounts reported in the Total column of the Summary Compensation Table required under SEC rules and are not a substitute for total compensation underas described in the 20152016 Summary Compensation Table.Table on page 41.

Key 20152016 Compensation-Related Actions

· Reaffirmed compensation philosophy to target our executive compensation at the median (50th percentile) of comparator group companies.

· Revised our annual incentive plan metrics to more closely align with our market-led enterprise strategy and revised market-led organizational design.

· Thoroughly reviewed our Talent Market and Business Segment comparator groups to ensure alignment with our renewed enterprise strategic plan, adjusted in the members of the Business Segment group and the selection criteria for the Talent Market group and confirmed the appropriate usage of the two groups.

·Conducted formal pay-for-performance review of CEO compensation versus peers.

·Conductedpeers and realizable pay analysis to assess whether Company performance and CEO realizable pay are aligned over a given period of time.period.

· Evaluated compensation packagespackage for outgoing Chairman and CEO, new President and CEO and new Senior Vice President, General CounselGlobal Operations and Supply Chain and Vice President of Corporate Secretary.

2016 Annual MeetingStrategy and Proxy Statement | 3Investor Relations.

Table of Contents

GENERAL INFORMATION

|

|

Other Existing Key Compensation Features

· Clawback of incentive compensation

· No “single trigger” feature on parachute payments in change-in-control agreements offered to future executives

· No-hedging/no-pledging of company stock

· Independent compensation consultant

· Share ownership requirements

· Annual compensation risk assessment

· Limited perquisites and personal benefits

Auditors

Set forth below is summary information with respect to PricewaterhouseCoopers LLP’sPwC’s fees for services provided in 20152016 and 2014.2015.

Type of Fees | | 2015 | | 2014 | |

| | | | | |

Audit Fees | | $1,869,280 | | $1,657,566 | |

Audit-Related Fees | | 25,510 | | 17,500 | |

Tax Fees | | 315,374 | | 159,505 | |

All Other Fees | | 5,000 | | 11,366 | |

Total | | $2,215,164 | | $1,845,937 | |

2016 Annual Meeting and Proxy Statement | 4

Type of Fees | | 2016 | | 2015 | |

| | | | | |

Audit Fees | | $ | 1,935,280 | | $ | 1,869,280 | |

Audit-Related Fees | | 1,500 | | 25,510 | |

Tax Fees | | 224,014 | | 315,374 | |

All Other Fees | | 8,600 | | 5,000 | |

Total | | $ | 2,169,394 | | $ | 2,215,164 | |

Table of Contents

GENERAL INFORMATION

|

|

General Information About the Meeting |

Proxy Solicitation

Our Board of Directors is soliciting your vote on matters that will be presented at our 2016

Our Board of Directors is soliciting your vote on matters that will be presented at our 2017 Annual Meeting of Shareholders and at any adjournment or postponement. This Proxy Statement contains information on these matters to assist you in voting your shares. The Notice, the accompanying proxy card or voting instruction card and our 2016 Form 10-K, including our annual report wrapper, are being mailed starting on or about March 22, 2017. | | The Notice, the accompanying proxy card or voting instruction card and our 2015 Form 10-K, including our annual report wrapper, are being mailed starting on or about March 23, 2016.

|

Shareholders Entitled to Vote

All shareholders of record of our common stock, par value $.25 per share, at the close of business on March 8, 2016,All shareholders of record of our common stock, par value $.25 per share, at the close of business on March 7, 2017, are entitled to receive the Notice and to vote their shares at the meeting. As of that date, 73,326,840 shares of our common stock were outstanding. Each share is entitled to one vote on each matter properly brought to the meeting.

| | As of that date, 72,712,473 shares of our common stock were outstanding. Each share is entitled to one vote on each matter properly brought to the meeting.

|

You may vote at the Annual Meeting by delivering a proxy card in person or you may cast your vote in any of the following ways:

|

|

|

|

| |

|

Mailing your signed proxy card or votervoting instruction card. | | Using the Internet at www.ProxyVote.com. | | Calling toll-free from the United States, U.S. territories and Canada to 1-800-690-6903. |

How Your Shares Will Be Voted

In each case, for registered shareholders, your shares will be voted as you instruct. If you return a signed card, but do not provide voting instructions, your shares will be voted FOR each of the proposals. You may revoke or change your vote any time before the proxy is exercised by filing with our Corporate Secretary a notice of revocation or a duly executed proxy bearing a later date. You may also vote in person at the meeting, although attendance at the meeting will not by itself revoke a previously granted proxy. If you hold shares in the Company in “Street name” or through a broker, please refer to “Broker Voting” on the next page. Plan Participants. Any shares you may hold in the West Pharmaceutical Services, Inc. 401(k) Plan or the Tech Group Puerto Rico Savings and Retirement Plan have been added to your other holdings on your proxy card. Your completed proxy card serves as voting instructions to the trustee of those plans. You may direct the trustee how to vote your plan shares by submitting your proxy vote for those shares, along with the rest of your shares, by Internet, phone or mail, all as described on the enclosed proxy card. If you do not instruct the trustee how to vote, your plan shares will be voted by the trustee in the same proportion that it votes shares in other plan accounts for which it received timely voting instructions. Deadline for Voting. The deadline for voting by telephone or Internet is 11:59 PM Eastern Time on May 1, 2017. If you are a registered shareholder and attend the meeting, you may deliver your completed proxy card in person. “Street name” shareholders who wish to vote at the meeting will need to obtain a proxy form from the institution that holds their shares. Broker Voting If your shares are held in a stock brokerage account or by a bank or other holder of record, you are considered the “beneficial owner” of shares held in “Street name.” The Notice would have been made available to you by your broker, bank or other holder of record who is considered the shareholder of record of those shares. As the beneficial owner, you may direct your broker, bank or other holder of record on how to vote your shares by using the proxy card included in the materials made available to you or by following their instructions for voting instructions, your shares will be voted FOR each of the proposals. You may revoke or change your vote any time before the proxy is exercised by filing with our Corporate Secretary a notice of revocation or a duly executed proxy bearing a later date. You may also vote in person at the meeting, although attendance at the meeting will not by itself revoke a previously granted proxy. If you hold shares in the Company in “Street name” or through a broker, please refer to | | “Broker Voting” on the next page.

Plan Participants. Any shares you may hold in the West Pharmaceutical Services, Inc. 401(k) Plan or the Tech Group Puerto Rico Savings and Retirement Plan have been added to your other holdings on your proxy card. Your completed proxy card serves as voting instructions to the trustee of those plans. You may direct the trustee how to vote your plan shares by submitting your proxy vote for those shares, along with the rest of your shares, by Internet, phone or mail, all as described on the enclosed

|

2016 Annual Meeting and Proxy Statement | 5

Table of Contents

GENERAL INFORMATION

|

|

proxy card. If you do not instruct the trustee how to vote, your plan shares will be voted by the trustee in the same proportion that it votes shares in other plan accounts for which it received timely voting instructions.

Deadline for Voting. The deadline for voting by telephone or Internet is 11:59 PM Eastern Time

| | on May 2, 2016. If you are a registered shareholder and attend the meeting, you may deliver your completed proxy card in person. “Street name” shareholders who wish to vote at the meeting will need to obtain a proxy form from the institution that holds their shares.

|

If your shares are held in a stock brokerage account or by a bank or other holder of record, you are considered the “beneficial owner” of shares held in street name. The Notice would have been made available to you by your broker, bank or other holder of record who is considered the shareholder of record of those shares. As the beneficial owner, you may direct your broker, bank or other holder of record on how to vote your shares by using the proxy card included in the materials made available to you or by following their instructions for voting on the

| | Internet. A broker non-vote occurs when a broker or other nominee that holds shares for another does not vote on a particular item because the nominee does not have discretionary voting authority for that item and has not received instructions from the owner of the shares. Although there is no controlling precedent under Pennsylvania law regarding the treatment of broker non-votes in certain circumstances, we intend to apply the principles outlined in the table below: |

Proposal | | Votes Required | | Treatment of Abstentions and

Broker Non-Votes | | Broker

Discretionary

Voting |

Proposal 1 - Election of Directors | | The number of shares voted “for” a director must exceed the number of votes cast “against” that director.director | | Abstentions and broker non-votes will not be taken into account in determining the outcome of the proposal | | No |

Proposal 2 - Advisory Vote to Approve Named Executive Officer Compensation | | Majority of the shares present and entitled to vote on the proposal in person or represented by proxy | | Abstentions will have the effect of negative votes and broker non-votes will not be taken into account in determining the outcome of the proposal | | No |

Proposal 3 - ApprovalAdvisory Vote on Frequency of the adoption of the West Pharmaceutical Services, Inc. 2016 Omnibus IncentiveExecutive Compensation PlanVote | | MajorityPlurality of the shares present and entitled to vote on the proposal in person or represented by proxyvotes cast

| | Abstentions will have the effect of negative votes and broker non-votes will not be taken into account in determining the outcome of the proposal | | No |

Proposal 4 - Ratification of the Appointment of PricewaterhouseCoopers LLCLLP as our Independent Registered Public Accounting Firm for the 20162017 Year | | Majority of the shares present and entitled to vote on the proposal in person or represented by proxy | | Abstentions and broker non-votes will have the effect of negative votes | | Yes |

2016 Annual Meeting and Proxy Statement | 6

Table of Contents

GENERAL INFORMATION

|

|

Quorum

We must have a quorum to conduct business at the 2016 Annual Meeting. A quorum consists of the presence at the meeting either in person or represented by proxy of the holders of a majority of the outstanding shares of our common stock entitled to vote. For the purpose of establishing

| | We must have a quorum to conduct business at the 2017 Annual Meeting. A quorum consists of the presence at the meeting either in person or represented by proxy of the holders of a majority of the outstanding shares of our common stock entitled to vote. For the purpose of establishing a quorum, abstentions, including brokers holding customers’ shares of record who cause abstentions to be recorded at the meeting, and broker non-votes are considered shareholders who are present and entitled to vote, and count toward the quorum. |

Mailings to Multiple Shareholders at the Same Address

We have adopted a procedure called “householding” for making the Proxy Statement and the Annual Report available. Householding means that shareholders who share the same last name and address will receive only one copy of the materials, unless we are notified that one or more of these shareholders wishes to continue receiving additional copies. We will continue to make a proxy card available to each shareholder of record. If you prefer to receive multiple copies of the proxy materials at the same address, please contact us in writing or by telephone: Corporate Secretary, West Pharmaceutical Services, Inc., 530 Herman O. West Drive, Exton, PA 19341, (610) 594-3319. | | We will continue to make a proxy card available to each shareholder of record. If you prefer to receive multiple copies of the proxy materials at the same address, please contact us in writing or by telephone: Corporate Secretary, West Pharmaceutical Services, Inc., 530 Herman O. West Drive, Exton, PA 19341, (610) 594-3319.

|

Electronic Availability of Proxy Statement and Annual Report

We are pleased to be distributing our proxy materials to certain shareholders via the Internet under the “notice and access” approach permitted by the rules of the SEC. This method conserves natural resources and reduces our costs of printing and mailing while providing a convenient way for shareholders to review our materials and vote their shares.

| | On March 23, 2016,

We are pleased to be distributing our proxy materials to certain shareholders via the Internet under the “notice and access” approach permitted by the rules of the SEC. This method conserves natural resources and reduces our costs of printing and mailing while providing a convenient way for shareholders to review our materials and vote their shares. On March 22, 2017, we mailed a “Notice of Internet Availability” to participating shareholders, which contains instructions on how to access the proxy materials on the Internet. If you would like to receive a printed copy of our proxy materials, we will send you one free of charge. Instructions for requesting such materials are included in the Notice. |

This Proxy Statement and our 20152016 Annual Report are available at:

www.westpharma.com/na/en/Investors/Pages/ProxyMaterials.aspx http://investor.westpharma.com/phoenix.zhtml?c=118197&p=irol-reportsannual

Proxy Solicitation Costs

We pay the cost of soliciting proxies. Proxies will be solicited on behalf of the Board by mail, telephone, and other electronic means or in person. We have retained Georgeson Inc., 199 Water Street, 26th Floor, New York, NY 10038, to help with the solicitation for a fee of $8,500, plus reasonable out-of-pocket costs and expenses. We will reimburse brokerage firms and other custodians, nominees and fiduciaries their reasonable out-of-pocket expenses for forwarding solicitation materials to shareholders and obtaining their votes.

CORPORATE GOVERNANCE AND BOARD MATTERS

Corporate Governance and Board Matters

During 2016, our Board met six times. Each director attended at least 75% of the Board meetings and the meetings of the Board committees on which he or she served except for Paula Johnson who attended 40% of our Audit Committee meetings, 67% of our ITC Committee meetings and 67% of our Board meetings. All directors are expected to attend the 2017 Annual Meeting, and Proxy Statement | 7all our directors attended the 2016 Annual Meeting.

TableOur principal governance documents are our Corporate Governance Principles, Board Committee Charters, director qualification standards and Code of ContentsBusiness Conduct. Aspects of our governance documents are summarized below. We encourage our shareholders to read our governance documents, as they present a comprehensive picture of how the Board addresses its governance responsibilities to ensure our vitality and success. The documents are available in the “Investors — Corporate Governance” section of our website at www.westpharma.com and copies of these documents may be requested by writing to our Corporate Secretary, West Pharmaceutical Services, Inc., 530 Herman O. West Drive, Exton, PA 19341.

CORPORATE GOVERNANCE AND BOARD MATTERS

|

|

We pay the cost of soliciting proxies. Proxies will be solicited on behalf of the Board by mail, telephone, and other electronic means or in person. We have retained Georgeson Inc., 199 Water Street, 26th Floor, New York, NY 10038, to help with the solicitation for a fee of $8,500,

| | plus reasonable out-of-pocket costs and expenses. We will reimburse brokerage firms and other custodians, nominees and fiduciaries their reasonable out-of-pocket expenses for forwarding solicitation materials to shareholders and obtaining their votes.

|

Corporate Governance and Board Matters

|

During 2015, our Board met seven times. Each director attended at least 75% of the Board meetings and the meetings of the Board committees on which he or she served. All directors are expected to attend the 2016 Annual Meeting, and all of our directors attended the 2015 Annual Meeting.

Our principal governance documents are our Corporate Governance Principles, Board Committee Charters, director qualification standards and Code of Business Conduct. Aspects of our governance documents are

| | summarized below. We encourage our shareholders to read our governance documents, as they present a comprehensive picture of how the Board addresses its governance responsibilities to ensure our vitality and success. The documents are available in the “Investors — Corporate Governance” section of our website at www.westpharma.com and copies of these documents may be requested by writing to our Corporate Secretary, West Pharmaceutical Services, Inc., 530 Herman O. West Drive, Exton, PA 19341.

|

Corporate Governance Principles

Our Board has adopted Corporate Governance Principles to provide guidance to our Board and its committees on their respective roles, director qualifications and responsibilities, Board and committee composition, organization and leadership. During 2016, we significantly updated our Corporate Governance Principles to meet best practices in corporate governance and ensure the Corporate Governance Principles address our current and long-term business needs. Our revised Corporate Governance Principles to provide guidance to our Board and its committees on their respective roles, director qualifications and responsibilities, Board and committee composition, organization and leadership. Our Principles address, among other things: · Director qualification standards, including our independence standards;

· The requirement to hold separate executive sessions of the independent directors;

· The role of independent directors in executive succession planning;

| | · The Board’s policy on setting director compensation and director share-ownership guidelines;

· Guidelines on Board organization and leadership, including the number and structure of committees and qualifications of committee members;

· Guidelines on outside board memberships;

· Policies on access to management;

· Director orientation and education; and

· Self-assessments of board and committee performance to determine their effectiveness.

|

2016 Annual Meeting and Proxy Statement | 8

Table· Statements of Contents

CORPORATE GOVERNANCE AND BOARD MATTERS

|

|

the Board’s commitment to high ethical standards, principles of fair dealing and high ethical standards;

· The requirement to hold separate executive sessions of the independent directors;

· The importance of robust executive succession planning and the role of directors in succession planning;

· The Board’s policy on setting director compensation and director share-ownership guidelines;

· Guidelines on Board organization and leadership, including the number and structure of committees and qualifications of committee members;

· Guidelines on outside board memberships;

· Policies on making charitable contributions and prohibition of political contributions;

· Policies on access to Management;

· Requirements fostering leadership development by senior executives;

· Statements of our executive compensation philosophy and our independent auditor standards;

· Director orientation and education; and

· Self-assessments of Board and Committee performance to determine their effectiveness.

Code of Business Conduct

All of our employees, officers and directors are required to comply with our Code of Business Conduct as a condition of employment. The Code of Business Conduct covers fundamental ethical and compliance-related principles and practices such as accurate accounting records and financial reporting, avoiding conflicts of interest, protection and proper use of our

property and information and compliance with legal and regulatory requirements. In 2016, we substantially updated and enhanced our Code of Business Conduct. The Board has adopted a comprehensive Compliance and Ethics Program and has named Mr. Miller our Compliance Officer. Our Compliance Officer delivers regular reports on program developments and initiatives to the Audit Committee and the Board.

Board Leadership Structure

The current governance structure of the Board follows:

· The offices of Chairman and CEO are separate;

· The Board has established and follows robust corporate governance guidelines;

· All of the members of the Board, other than Mr. Green, are independent;

· The Audit, Compensation, Nominating and Corporate Governance and Innovation and TechnologyAll Board Committees are each composed solely of independent directors;

· Our independent directors meet regularly in executive session both at the Board and Board committee levels; and

· Our directors as a group possess a broad range of skills and experience sufficient to provide the leadership and strategic direction the Company requires as it seeks to enhance long-term value for shareholders.

Dr. Morel, the CEO prior to Mr. Green, served as both Chairman and CEO, whereas Mr. Green currently serves as President and CEO and Mr. Zenner serves as Chairman. The Board does not currently have a lead independent director, although the Board believes it may be useful and

appropriate to designate a lead independent director ifWhile the offices of Chairman and CEO are combined incurrently separate, the future.

The Board takes a flexible approach to the issue of whether the offices of Chairman and CEO should be separate or combined. This approach allows the Board to regularly evaluate whether it is in the best interests of the Company for the CEO or another director to hold the position of Chairman.

With the retirement of Dr. Morel and appointment of Mr. Green,The Board does not currently have a lead independent director, although the Board reassessedbelieves it may be useful and appropriate to designate a lead independent director if the combinationoffices of Chairman and CEO are combined in the CEO and Chairman positions. Effective upon Dr. Morel’s retirement as CEO, the Board determined that separating the positions is currently the best leadership structure for the Company.future.

We believe the current Board leadership structure is appropriate at this timenow because it allows the Chairman to focus on corporate governance and management of the Board priorities and allows the CEO to focus directly on managing our operations and growing the Company.

During previous CEO transitions, the Board has twice separated the CEO and Chairman roles. This approach has been successful in enabling the CEO to develop strategy in consultation with the Board and ensure the effective implementation of that strategy.

2016 Annual Meeting and Proxy Statement | 9

Table of Contents

CORPORATE GOVERNANCE AND BOARD MATTERS

|

|

Chairman of the Board of Directors

Upon Dr. Morel’s stepping down as CEO on April 24, 2015, he was named Chairman through June 30, 2015 to aid in the transition to Mr. Green as the new CEO. Upon Dr. Morel’s retirement as Chairman on June 30, 2015, Patrick J. Zenner, an independent director who is the Chairman of the Nominating and Corporate Governance Committee and previously served as the Chairman, Independent Directors, was appointed by the Board effective in July 2015 to serve as the Chairman of the Board until the 2016 Annual Meeting of Shareholders. The responsibilities of the Chairman include:

· Chairing Board meetings, including executive sessions of the independent directors;

· Approving agendas and schedules for each Board meeting in consultation with the CEO; and,

· Serving as principal liaison between the CEO and the independent directors.

Each independent director may add items to the agenda. Independent directors meet in regularly scheduled executive sessions and in special executive sessions called by the Chairman.

The Board has fourfive standing committees:

· Audit Committee;

· Compensation Committee;

· Finance Committee;

· Innovation and Technology Committee; and,

·Nominating and Corporate Governance Committee; and,

·Innovation and Technology Committee.

The Finance Committee was added in 2016 to review proposals made by Management regarding the optimal capital structure and spending of the Company, analyze, oversee and approve potential opportunities for business combinations, acquisitions, divestitures and similar strategic transactions and to ensure all transactions are in alignment with the Company’s strategic plan. From time to time, the Board may form ad hoc committees to address specific situations as they may arise. During 2014, the Board established one ad hoc committee, the Succession Planning

Committee. The Succession Planning Committee was dissolved upon the appointment of Mr. Green as CEO on April 24, 2015. Each committee consists solely of independent directors. Each standing committee has a written charter, which is posted in the “Investors—Corporate Governance” section of our website at www.westpharma.com.

You may request a printed copy of each standing committee’s charter from our Corporate Secretary.

Audit Committee

Audit Committee

|

| | |

Mark A. Buthman (Chair)

William F. Feehery

Thomas W. Hofmann

Paula A. Johnson

Douglas A. MichelsPaolo Pucci | | The Audit Committee assists our Board in its oversight of: (1) the integrity of our financial statements; (2) the independence and qualifications of our independent auditors; (3) the performance of our internal audit function and independent auditors; and (4) our compliance with legal and regulatory requirements. In carrying out these responsibilities, the Audit Committee, among other things: · Reviews and discusses our annual and quarterly financial statements with managementManagement and the independent auditors; · Manages our relationship with the independent auditors, including having sole authority for their appointment, retention and compensation; reviewing the scope of their work; approving non-audit and audit services; and confirming their independence; and · Oversees management’sManagement’s implementation and maintenance of disclosure controls and procedures and internal control over financial reporting. |

2016 Annual Meeting and Proxy Statement | 10

Table of Contents

CORPORATE GOVERNANCE AND BOARD MATTERS

|

|

| | The Board has determined that Mr. Buthman and Mr. Hofmann are each an “audit committee“Audit Committee financial expert” as defined in SEC regulations. In 2015,2016, the Audit Committee met seven times. All members of the Audit Committee are |

| | independent as defined in the listing standards of the New York Stock Exchange (“NYSE”) and the Company’s Corporate Governance Principles. |

| | |

Compensation Committee | | |

| | |

John H. WeilandDouglas A. Michels (Chair)

Thomas W. Hofmann

Douglas A. MichelsPaolo Pucci

John H. Weiland

| | The Compensation Committee develops our overall compensation philosophy, and, either as a committee or together with the other independent directors, determines and approves our executive compensation programs, makes all decisions about the compensation of our executive officers and oversees our cash and equity-based incentive compensation plans. Additional information about the roles and responsibilities of the Compensation Committee can be found under the heading “Compensation Discussion and Analysis.” In 2015,2016, the Compensation Committee met sevensix times. All members of the Compensation Committee are independent as defined in the listing standards of the NYSE and the Company’s Corporate Governance Principles. |

| | |

NominatingFinance Committee

| | |

| | |

John H. Weiland (Chair)

Thomas W. Hofmann

Myla P. Lai-Goldman | | The Finance Committee reviews proposals made by Management and recommends to the full Board optimal capital structure of the Company and adjustments and the way capital is allocated and deployed by the Company. The Finance Committee analyzes and makes recommendations to the full Board with respect to potential opportunities for business combinations, acquisitions, mergers, disposition, divestitures and similar strategic transactions involving the Company. The Finance Committee also ensures all strategic transactions are in alignment with the Company’s strategic business plan and oversees the process of reviewing, negotiating, consummating and/or integrating potential strategic transactions. In 2016, the Finance Committee met three times. All members of the Finance Committee are independent as defined in the listing standards of the NYSE and the Company’s Corporate Governance Principles. |

| | |

Innovation and Technology Committee |

| | |

Patrick J. ZennerPaula A. Johnson (Chair)

Myla P. Lai-Goldman

Douglas A. Michels

| | The Innovation and Technology Committee provides guidance to our Board on technical and commercial innovation strategies, reviews emerging technology trends that may affect our business, reviews our major innovation and technological programs and overall patent strategies, and assists our Board in making well-informed choices about investments in new technology. In 2016, the Innovation and Technology Committee met three times. |

| | |

Nominating and Corporate Governance Committee |

|

William F. Feehery (Chair)

Mark A. Buthman

Anthony WeltersPatrick J. Zenner | | The Nominating and Corporate Governance Committee identifies qualified individuals to serve as board members; recommends nominees for director and officer positions; determines the appropriate size and composition of our Board and its committees; monitors a process to assess Board effectiveness; reviews related-party transactions; and considers matters of corporate governance. The Committee also reviews and makes recommendations to the Board regarding compensation for non-employee directors and administers director equity-based compensation plans. In 2015,2016, the Nominating and Corporate Governance Committee met fivefour times. All members of the Committee are independent as defined in the listing standards of the NYSE and the Company’s Corporate Governance Principles. |

| | |

Innovation and Technology Committee

|

| | |

William F. Feehery (Chair)

Paula A. Johnson

Myla P. Lai-Goldman

| | The Innovation and Technology Committee provides guidance to our Board on technical and commercial innovation strategies, reviews emerging technology trends that may affect our business, reviews our major innovation and technological programs and overall patent strategies, and assists our Board in making well-informed choices about investments in new technology. In 2015, the Innovation and Technology Committee met three times.

|

| | |

Succession Planning Committee (Ad Hoc)

|

| | |

Patrick J. Zenner (Chair)

Thomas W. Hofmann

Myla P. Lai-Goldman

John H. Weiland

| | The Succession Planning Committee was an ad hoc committee formed in 2014 to provide guidance to our Board on succession planning for the impending retirement of Dr. Morel, announced in October 2014. Dr. Morel’s retirement as CEO occurred in April 2015, and he remained Chairman through June 30, 2015. In 2015, the Succession Planning Committee met four times. This Committee was dissolved upon the appointment of Mr. Green as CEO.

|

2016 Annual Meeting and Proxy Statement | 11

During 2015,2016, our Board and each of its Committees played pivotal roles in helping to develop and approve our corporate strategy. The major issues debated and decided by the Board during 20152016 included:

· Selecting Mr. Green as successor to Dr. Morel;

· Separating the CEO and Chairman roles;

· ApprovingReviewing our progress on our revised enterprise strategic plan;

· Establishment of a new Finance Committee to assist with corporate strategy and strategic partnerships;

·Reviewing the hiring of: (1) a new Senior Vice President of Operations and approving our executiveGlobal Supply Chain, and board compensation strategies;(2) a new Vice President of Corporate Strategy and Investor Relations;

· Reviewing potential targets for mergers and acquisitions and potential licensing opportunities.opportunities;

· Continuation of a strategic share buyback program; and

· Substantial updates to our Corporate Governance Principles and Code of Business Conduct.

The Board’s Role in Risk Oversight

The Board’s role in risk oversight is consistent with our leadership structure, with managementManagement having day-to-day responsibility for assessing and managing our risk exposure and the Board actively overseeing managementManagement of our risks—both at the Board and committee level.

The Board regularly reviews and monitors the risks associated with our financial condition and operations and specifically reviews the enterprise risks associated with our five-year plan. In particular, the Board reviews our risk portfolio, confirms that managementManagement has established risk-management processes that are functioning effectively and efficiently and are consistent with our corporate strategy, reviews the most significant risks and determines whether managementManagement is responding appropriately.

The Board performs its risk oversight role by using several different levels of review. Each Board meeting begins with a strategic overview by the CEO that describes the most significant issues, including risks, affecting the Company and also includes business updates from each reportable segment. In addition, the Board reviews in detail the business and operations of each reportable segment quarterly, including the primary risks associated with that segment.

The Board focuses on the overall risks affecting West. Each committee has been delegated the responsibility for the oversight of specific risks that fall within its areas of responsibility. For example:

· The Compensation Committee is responsible for overseeing the management of risks relating to our executive compensation policies, plans and arrangements and the extent to which those policies or practices increase or decrease risk for the Company.

· The Audit Committee oversees management of financial reporting, compliance and litigation risks as well as the steps managementManagement has taken to monitor and control such exposures.

· The Finance Committee assesses the risks associated with allocation of our capital, potential acquisitions, divestitures and major business partnerships.

· The Innovation and Technology Committee reviews risks associated with intellectual property, innovation efforts and our technology strategy.

· The Nominating and Corporate Governance Committee manages risks associated with the independence of the Board, potential conflicts of interest and the effectiveness of the Board.

· The Innovation and Technology Committee reviews risks associated with intellectual property, innovation efforts and our technology strategy.

· The ad hoc Succession Planning Committee reviewed risks associated with choosing a new Chief Executive Officer and ensuring an effective transition from Dr. Morel to his successor.

Although each committee is responsible for evaluating certain risks and overseeing the management of those risks, the full Board is regularly informed about those risks through committee reports.

2016 Annual Meeting and Proxy Statement | 12

Our Board has adopted a formal set of categorical director qualificationindependence determination standards (“Standards”) used to determine director independence.. The Standards meet or exceed the independence requirements of the NYSE corporate governance listing standards. Under the Standards, a director must have no material relationship with us other than as a director. The Standards specify the criteria for determining director independence, including strict guidelines for directors and their immediate families regarding employment or affiliation with us, members of our senior managementManagement or their affiliates. The full text of the Standards may be found under the “Investors — Corporate Governance

Governance” section on our website at www.westpharma.com.

The Board undertook its annual review of director independence in February 2016.2017. As a result of this review, the Board did not substantively revise the Standards. Subsequently, the Board considered whether any relationships described under the Standards between the Company and each individual director existed. As a result of the review, the Board affirmatively determined that each of its non-employee directors is independent of the Company and its managementManagement team as defined under the Standards.

Executive Sessions of Independent Directors

Our Board also holds regular executive sessions of only independent directors to review the Company’s strategy and management’sManagement’s operating plans, the criteria by which our CEO and other senior executives are measured,

management’s Management’s performance against those criteria and other related issues and to conduct a self-assessment of its performance. Last year, our independent directors held sevensix executive sessions.

Director Mandatory Retirement

A non-employee director must retire on the date of the annual meetingAnnual Meeting of shareholdersShareholders immediately following his or her 72nd birthday.

An employee director must submit his or her resignation upon the date he or she ceases to be an executive of the Company.

Director Education

The Board believes shareholders are best served by Board members who are well versed in corporate governance principles and other subject matters relevant to board service. Therefore, all directors are encouraged to attend any director education programs they consider appropriate to stay informed about developments in corporate governance and the markets we serve. The Company reimburses directors for the reasonable costs of attending director education programs. To encourage continuing director education, the Board also arranges for a series of annual educational presentations on its calendar.

Share Ownership Goals for Directors and Executive Management

To encourage significant share ownership by our directors and further align their interests with the interests of our shareholders, directors are expected to acquire within three years of appointment, and to retain during their Board tenure, shares of our common stock equal in

value to at least five times their annual retainer. All directors meet this requirement or are within the three-year period to obtain the necessary shares. The Board has also set share ownership goals for senior executive management,Management, which are set forth indescribed under “Compensation Discussion and Analysis — Other Compensation Policies.”

2016 Annual Meeting and Proxy Statement | 13

Communicating with the Board

You may communicate with the Chairman of the Board or the independent directors as a group by sending a letter addressed to the Board of Directors, c/o Corporate Secretary,, West Pharmaceutical Services, Inc., 530 Herman O. West Drive, Exton, Pennsylvania 19341. Communications to a particular director should be addressed to that director at the same address.

Our Corporate Secretary maintains a log of all communications received through this process. Communications to specific directors are forwarded to those directors. All other communications are given directly to the Chairman of the Board who decides whether they should be forwarded to a particular Board committee or to managementManagement for further handling.

Nomination of Director Candidates

Candidates for nomination to our Board are selected by the Nominating and Corporate Governance Committee in accordance with the Committee’s charter, our Amended and Restated Articles of Incorporation, our Bylaws and our Corporate Governance Principles. All persons recommended for nomination to our Board, regardless of the source of the recommendation, are evaluated by the Committee.

The Board and the Nominating and Corporate Governance Committee consider, at a minimum, the following factors in recommending potential new Board members or the continued service of existing members:

· A director is nominated based on his or her professional experience. A director’s traits, expertise and experience add to the skill-set of the Board as a whole and provide value in areas needed for the Board to operate effectively.

· A director must have high standards of integrity and commitment, and exhibit independence of judgment, a willingness to ask hard questions of managementManagement and the ability to work well with others.

· A director should be willing and able to devote sufficient time to the affairs of the Company and be free of any disabling conflict.

· All of the non-employee directors should be “independent” as outlined in our Standards.

· A director should exhibit confidence and a willingness to express ideas and engage in constructive discussion with other Board members, Company managementManagement and all relevant persons.

· A director should actively participate in the decision-making process, be willing to make difficult decisions, and demonstrate diligence

and faithfulness in attending Board and committee meetings.

· The Board generally seeks active or former senior-levelsenior executives of public companies, particularly those with international operations, leaders in the healthcare or public health fields, with science or technology backgrounds, and individuals with financial expertise.

When reviewing nominees, the Nominating and Corporate Governance Committee considers whether the candidate possesses the qualifications, experience and skills it considers appropriate in the context of the Board’s overall composition and needs. The Nominating and Corporate Governance Committee also values diversity on the Board in the director nominee identification and nomination process. Our Corporate Governance Principles were revised in 2016 to specifically include a statement of the importance of board diversity to ensure that the director nomination process considers a diverse mix of background, age, gender, sexual orientation, and cultural and ethnic composition.

Accordingly, the Committee’s evaluation of director nominees includes consideration of their ability to contribute to the diversity of personal and professional experiences, opinions, perspectives and backgrounds on the Board. The Committee regularly assesses the effectiveness of this approach as part of its review of the Board’s composition.

To assist it with its evaluation of the director nominees for election at the 20162017 Annual Meeting, the Committee took into accountconsidered the factors listed above and used a skills matrix highlighting the experience of our directors in areas such as industry experience, international background, leadership, financial literacy, risk management expertise and independence.

Under the heading “Director Qualifications and Biographies,” we provide an overview of each

2016 Annual Meeting and Proxy Statement | 14

nominee’s principal occupation, business experience and other directorships of publicly-traded companies, together with the qualifications, experience, key attributes and skills the Committee and the Board believe will best serve the interests of the Board, the Company and our shareholders.

Shareholders who wish to recommend or nominate director candidates must provide information about themselves and their candidates and comply with procedures and timelines contained in our Bylaws. These procedures are described under “Other Information — 20172018 Shareholder Proposals or Nominations” in this Proxy Statement.

Related Person Transactions and Procedures

The Board has adopted written policies and procedures relating to the Nominating and Corporate Governance Committee’s review and approval of transactions with related persons that are required to be disclosed in proxy statements under SEC regulations. A “related person” includes our directors, officers, 5% shareholders and immediate family members of these persons.

Under the policy, the Nominating and Corporate Governance Committee reviews the material facts of all related-person transactions, determines whether the related person has a material interest in the transaction and may approve, ratify, rescind or take other action with respect to the transaction.

In approving a transaction, the Committee will take into account,consider, among other factors, whether

the transaction is on terms no less favorable than terms generally available to an unaffiliated third party under the same or similar circumstances and the extent of the related person’s interest in the transactions.

The Committee reviews and pre-approves certain types of related person transactions, including certain transactions with companies at which the related person is an employee only, and charitable contributions that would not disqualify a director’s independent status. The policy and procedures can be found in the “Investors—Corporate Governance — Related Party Transaction Policies and ProceduresGovernance Documents” section of our website,www.westpharma.com.

We have no related person transactions required to be reported under applicable SEC rules.

DIRECTOR COMPENSATION

Director Compensation

2016 Annual MeetingDirector Compensation

After consulting with Pay Governance LLC, the Board’s independent compensation consultant, the Board approved changes to the compensation structure for our non-employee directors effective January 1, 2016, which was discussed in our 2015 Proxy Statement. This structure increased the restricted stock units granted annually by $30,000 and Proxy Statement | 15increased cash compensation to reflect market trends. The Compensation Committee Chairman fee was increased in recognition of the significant additional duties required of that role. The compensation structure in effect for all of 2016 is set forth below.

Compensation Item | | Amount | |

| | | |

Annual Retainers and Chair Fees | | | |

Board membership | | $ | 80,000 | |

Chairman of the Board | | 100,000 | * |

Audit Committee Chair | | 20,000 | |

Compensation Committee Chair | | 20,000 | |

All Other Committee Chairs | | 10,000 | |

Restricted Stock Units | | 160,000 | |

| | | | |

Table of Contents

DIRECTOR COMPENSATION

|

|

* Payable in cash or restricted stock, which vests 25% per quarter, as elected annually by the Chairman.

2015 Director Compensation

During 2015, our non-employee directors received annual grants of stock-settled restricted stock units (“RSUs”) equal to $130,000 and a cash annual retainer of $70,000. The following table shows the structure of total 20152016 compensation of our non-employee directors.

Non-Employee Director Compensation Elements (2015)

Compensation Item

| | 2015 Amount

| |

| | | |

Annual Retainers and Chair Fees

| | | |

Board membership

| | $70,000

| |

Chairman, Independent Directors

| | 20,000

| |

Audit Committee Chair

| | 15,000

| |

All Other Committee Chairs

| | 10,000

| |

Restricted Stock Units

| | 130,000

| |

| | | |

Ad Hoc Succession Planning Committee

Due to the importance of attracting and selecting appropriate CEO candidates, the Board approved a special one-time payment to members of the ad hoc Succession Planning Committee when Mr. Green was hired on April 24, 2015. The Chairman of the Committee, Mr. Zenner, received a payment of $15,000 and the other Committee members, Mr. Hofmann, Dr. Lai-Goldman, and Mr. Weiland, received $10,000 each.

Chairman of the Board

In light of the additional duties imposed upon a non-executive Chairman of the Board in May 2015, the Nominating and Corporate Governance Committee approved additional compensation for the Chairman of the Board. Mr. Zenner, who was appointed Chairman, recused himself from the discussion and the Board sought the input of Pay Governance LLC, the Company’s independent compensation consultant, who benchmarked compensation practices. The Board determined that an additional retainer of $100,000 per year should be paid to the Chairman of the Board. This retainer is in lieu

| | of any fees otherwise payable as Chairman, Independent Directors. The $100,000 may be delivered in cash, payable 25% per quarter, or restricted stock that vests 25% per quarter as elected by the Chairman, provided that he remains in service with the Board. Absent an election, the amount is paid $50,000 in cash and $50,000 in restricted stock. Mr. Zenner was elected Chairman as of July 1, 2015 to serve until the 2016 Annual Meeting of Shareholders, a period of ten months. Therefore, the $100,000 payment was pro-rated to be $83,333. Mr. Zenner elected to have 50% of this amount paid in cash and 50% delivered in restricted stock.

2016 Changes to Board Compensation

Additionally, after consulting with Pay Governance, the Board approved changes to the compensation structure for our non-employee directors effective January 1, 2016. This new structure provides for $160,000 in restricted stock units annually (an increase of $30,000) and increases in cash compensation to reflect market trends. The Compensation Committee Chairman fee was increased in recognition of the additional duties required of that role. The new 2016 compensation structure is set forth below.

|

2016 Annual Meeting and Proxy Statement | 16

Table of Contents

DIRECTOR COMPENSATION

|

|

Non-Employee Director Compensation Elements

(Effective January 2016)

Compensation Item

| | 2016 Amount

| |

| | | |

Annual Retainers and Chair Fees

| | | |

Chairman of the Board (cash or stock, as elected)

| | $100,000

| |

Board membership

| | 80,000

| |

Audit Committee Chair

| | 20,000

| |

Compensation Committee Chair

| | 20,000

| |

All Other Committee Chairs

| | 10,000

| |

Restricted Stock Units

| | 160,000

| |

| | | |

The following table shows the total 2015 compensation of our non-employee directors.

2015 Non-Employee Director Compensation

Name | | Fees Earned

or Paid

in Cash

($) | | Stock Awards

($) | | All Other

Compensation

($) | | Total

($) | |

Mark A. Buthman | | 85,000 | | 130,000 | | 9,991 | | 224,991 | |

William F. Feehery | | 80,000 | | 130,000 | | 7,032 | | 217,032 | |

Thomas W. Hofmann | | 80,000 | | 130,000 | | 15,330 | | 225,330 | |

Paula A. Johnson | | 70,000 | | 130,000 | | 20,122 | | 220,122 | |

Myla P. Lai-Goldman | | 80,000 | | 130,000 | | 1,716 | | 211,716 | |

Douglas A. Michels | | 70,000 | | 130,000 | | 11,446 | | 211,446 | |

John H. Weiland | | 90,000 | | 130,000 | | 25,358 | | 245,358 | |

Anthony Welters | | 70,000 | | 130,000 | | 42,788 | | 242,788 | |

Patrick J. Zenner | | 127,526 | | 130,000 | | 24,365 | | 281,891 | |

Fees Earned or Paid in Cash

The amounts in the “Fees Earned or Paid in Cash” column are retainers earned for serving on our Board, its committees and as committee chairs and Chairman, Independent Directors or Chairman, as applicable. All annual retainers are paid quarterly. For Mr. Zenner this amount includes the pro rata portion of his fees for serving as Chairman of the Board after July 1,

Stock Awards

The amounts in the “Stock Awards” column reflect the grant date fair value of stock-settled RSU awards made in 2015. The grant date fair value is determined under Financial Accounting Standards Board Accounting Standards Codification (“FASB ASC”) Topic 718. In 2015, each non-employee director was awarded 2,448 RSUs, with a grant date fair market value of $53.10 per share based on the closing price of our common stock on the award date, May 5,

| | 2016 and Lead Independent Director before that. The amounts are not reduced to reflect elections to defer fees under the Non-Qualified Deferred Compensation Plan for Non-Employee Directors (“Director Deferred Compensation Plan”). During 2015, Mr. Buthman, Dr. Lai-Goldman, Mr. Michels, Mr. Weiland, and Mr. Welters deferred 100% of their cash compensation.

2015. For a discussion on RSU grant date fair value, refer to Note 12 of the consolidated financial statements included in our 2015 Form 10-K.

RSUs are granted on the date of our Annual Meeting and fully vest on the date of the next Annual Meeting so long as a director remains on the Board as of that date. Generally, all unvested grants of equity forfeit upon termination.

|

2016 Annual Meeting and Proxy Statement | 17

Name | | Fees Earned or Paid

in Cash

($) | | Stock Awards

($) | | All Other

Compensation

($) | | Total

($) | |

Mark A. Buthman | | 96,250 | | 160,000 | | 12,847 | | 269,097 | |

William F. Feehery | | 87,500 | | 160,000 | | 8,889 | | 256,389 | |

Thomas W. Hofmann | | 77,500 | | 160,000 | | 16,618 | | 254,118 | |

Paula A. Johnson | | 81,667 | | 160,000 | | 20,788 | | 262,455 | |

Myla P. Lai-Goldman | | 77,500 | | 160,000 | | 3,363 | | 240,863 | |

Douglas A. Michels | | 85,833 | | 160,000 | | -0- | | 245,833 | |

Paolo Pucci (1) | | 4,153 | | 105,148 | | 29,771 | | 139,072 | |

John H. Weiland | | 90,833 | | 160,000 | | 29,771 | | 280,604 | |

Anthony Welters (2) | | 44,713 | | -0- | | 7,688,890 | | 7,733,603 | |

Patrick J. Zenner | | 128,539 | | 160,000 | | 26,552 | | 315,091 | |

Table(1) Mr. Pucci commenced service as a director on September 12, 2016 and the annual stock award typically granted in May of Contentseach year was pro-rated accordingly.

DIRECTOR COMPENSATION

(2) Mr. Welters retired as a director on May 3, 2016 and received a full distribution of his account under the Director Deferred Compensation Plan. Fees Earned or Paid in Cash |

|

However, if a director retires during the calendar year that he reaches age 72, the award will vest pro rata on a monthly basis through the date of retirement.

The amounts in the “Fees Earned or Paid in Cash” column are retainers earned for serving on our Board, its committees and as committee chairs and Chairman, Independent Directors or Chairman, as applicable. All annual retainers are paid quarterly. For Mr. Zenner this amount includes his fees for serving as Chairman of the Board. Stock-settled RSUs are distributed upon vesting, unless a director elects to defer the award under the Director Deferred Compensation Plan. In 2015, all continuing directors elected to defer

| | their awards except for Mr. Hofmann and Mr. Zenner. All awards are distributed as shares of common stock, as described below. When dividends are paid on common stock, additional shares are credited to each director’s deferred stock account as if those dividends were used to purchase additional shares.

|

| | |

All Other Compensation

The amounts in the “All Other Compensation” column are the sum of the: (1) Dividend Equivalent Units (“DEUs”) credited to accounts under the Director Deferred Compensation Plan, and (2) with respect to Mr. Zenner and Ms.

| | Johnson, a charitable contribution of $1,000 each was made under our charitable contribution matching program, which is available to our employees, retirees and directors on a non-discriminatory basis.

|

| | |

Stock Options

Prior to 2007, non-employee directors received annual grants of stock options, which vested on the first anniversary of the grant date. After benchmarking this practice, our Board ceased granting stock options to directors. All stock

| | options are vested and expire ten years after the original date of grant. The following table sets forth all stock and stock options held by each director at the end of 2015.

|

The amounts are not reduced to reflect elections to defer fees under the Non-Qualified Deferred Compensation Plan for Non-Employee Directors (“Director Deferred Compensation Plan”). During 2016, Mr. Buthman, Mr. Michels, Mr. Pucci, Mr. Weiland and Mr. Welters deferred 100% of their cash compensation. Dr. Lai-Goldman deferred 50% of her fees.

Stock Awards

The amounts in the “Stock Awards” column reflect the grant date fair value of stock-settled restricted stock unit (“RSU”) awards made in 2016. The grant date fair value is determined under Financial Accounting Standards Board Accounting Standards Codification (“FASB ASC”) Topic 718. In 2016, each continuing non-employee director was awarded 2,262 RSUs, with a grant date fair market value of $70.73 per share based on the closing price of our common stock on the award date, May 3, 2016. Mr. Pucci was given a prorated award upon the commencement of his service on September 12, 2016. His award was for 1,277 Shares and had a grant date fair value of $105,148. For a discussion on RSU grant date fair value, refer to Note 12 of the consolidated financial statements in our 2016 Form 10-K.

RSUs are granted on the date of our Annual Meeting (or, as in the case with Mr. Pucci, upon commencement of service) and fully vest on the date of the next Annual Meeting so long as a director remains on the Board as of that date. Generally, all unvested grants of equity forfeit upon termination. However, if a director retires during the calendar year that he reaches age 72, the award will vest pro rata on a monthly basis through the date of retirement.

Stock-settled RSUs are distributed upon vesting, unless a director elects to defer the award under the Director Deferred Compensation Plan. In 2016, all continuing directors (including Mr. Pucci) elected to defer their awards except for Mr. Hofmann and Dr. Johnson. All awards are distributed as shares of common stock, as described below. When dividends are paid on common stock, additional shares are credited to each director’s deferred stock account as if those dividends were used to purchase additional shares.

All Other Compensation

The amounts in the “All Other Compensation” column are the sum of the: (1) Dividend Equivalent Units (“DEUs”) credited to accounts under the Director Deferred Compensation Plan; (2) with respect to Mr. Welters a distribution of $77,444 in cash (for amounts invested in his cash account and residual share value) and 101,604 shares of stock with an average per share value of $74.55 and total value of $7,651,590 from the Director Deferred Compensation Plan due to his retirement in May 2016; and, (3) with respect to Dr. Johnson, Mr. Weiland, Mr. Welters and Dr. Feehery, a charitable contribution of $1,000 each was made under our charitable contribution matching program, which is available to our employees, retirees and directors on a non-discriminatory basis.

Outstanding Director Stock Awards and Stock Options at Year-End 20152016

Name | | Vested Deferred Stock

Awards

(#) | | Unvested Deferred

Stock and RSU Awards

(#) | | Total Deferred Stock

and RSU Awards

(#) | | Stock Options

Outstanding

(#) | |

Mark A. Buthman | | 17,122 | | 2,457 | | 19,579 | | — | |

William F. Feehery | | 12,242 | | 2,457 | | 14,699 | | — | |

Thomas W. Hofmann | | 32,180 | | 2,457 | | 34,637 | | — | |

Paula A. Johnson | | 33,594 | | 2,457 | | 36,051 | | 7,800 | |

Myla P. Lai-Goldman | | 3,055 | | 2,457 | | 5,512 | | — | |

Douglas A. Michels | | 17,122 | | 2,457 | | 19,579 | | — | |

John H. Weiland | | 36,648 | | 2,457 | | 39,105 | | — | |

Anthony Welters | | 36,648 | | 2,457 | | 39,105 | | — | |

Patrick J. Zenner | | 37,078 | | 2,457 | | 39,535 | | 12,800 | |

Director Deferred Compensation Plan

All non-employee directors may participate in the Director Deferred Compensation Plan, which permits participants to defer all or a part of their annual cash compensation until their Board service terminates. Deferred fees may be credited to a “stock-unit” account that is deemed invested in our common stock or to an account that earns interest at the prime rate of our principal commercial bank. Stock-unit accounts are credited with DEUs based on the number of stock units credited on the dividend record date.